This blog has been moved - please view it at http://www.tiains.com/blog

Monday, December 2, 2013

Tuesday, November 26, 2013

Planning on Spending Money on Black Friday? Read about My Favorite FREE Things...

With everyone planning their Black Friday and Cyber Monday shopping, I thought I would mention a few of my favorite FREE things.. yes you read that right.. FREE!

Literacy is one of my personal favorites, especially when it comes to children. Here are a few of my favorite resources:

- Dolly Parton's Imagination Library: This is a FREE mail order book program for children up to age 5. It is hosted by an affilliate in your local community like your public library for example. Find out more or register your child here .

- Free Children's Books Online or for FREE download. It is a growing library of unique children's books and available for download or read online. They can be found at here.

- You can also visit Amazon for several Free books for Kindle for adults and children. Find them here.

Which brings me to my next category - computer software:

- Adobe Acrobat Reader - a free download that is required to read the downloaded books I mentioned above. Many files are saved in this format and because the program is FREE - everyone can have access. You can download the Free Reader Here.

- Microsoft Security Essentials - quit spending money on antivirus programs that fail. This is an excellent FREE antivirus program that protects your computer perhaps even better than some of the paid versions! It doesn't work for MAC though... that's the only downfall.. get it HERE. After installing you should scan your system weekly.

- If you are going to use the free antivirus from Microsoft then you should also download Malwarebytes Anti-Malware software - this provides excellent free protection from malware & spyware. Get it here. After installing you should scan your system weekly.

- A business partner introduced me to Jing - a free program that lets you capture images displayed on your computer screen. All or part of it. I used to print to another program if I wanted to save something in internet explorer and 99% of the time it would not print the entire page - it would get 'cut off'. Jing solved this problem. I have used it several times since I installed it. Get it here for FREE. Works for PC or Mac.

More Free stuff:

- I might be a little bias but we offer several FREE reports on our website - if you are a parent with a teen driving soon, or going away to college, getting married, moving, retiring, if you have a commercial drivers license or if you are an apartment building owner or farm owner, we have Free reports for each of those categories. Some of these can be read online and others are available for FREE download.

- We also offer a FREE insurance review. Everyone thinks.. 'I'm happy with what I have..." are you sure? Do you know if you and your family will be protected if you get into an auto accident or if someone slips and falls on your property. Don't take chances with your family.. your home, business and future earnings could be jeopardy. Get peace of mind by confirming that you adequate limits to protect yourself and your family. Contact us for a free review , even if we are not the agent of record on the policy.

If you have questions or need more information, feel free to contact me via email, phone or stop into the office.

Happy Holidays!

My blog is moving... please visit my blog on its new site HERE.

Monday, November 25, 2013

Year End Tax Tips for Everyone

Happy Monday! With 2013 coming to a close, almost, I thought I would focus on some end of the year tax tips.

In general, there are some end of the year tax tips that can be done to manage your income taxes. For example you may want to try to earn additional income in 2013 or perhaps you want to defer (push ahead) income to 2014, depending upon what tax bracket you are in. These tactics can be used to optimize your tax liability between 2013 & 2014.

Here are some more tax tips for individuals:

- Accelerate or defer expenses. Much like the income tip I mentioned above. Making that major purchase in 2013 may benefit you more if you hold off til 2014. Look at the benefits, tax credits and liability before you decide.

- Are you thinking of getting married? I would look at your tax liability as a married couple before you decide.. you may want to postpone til after the new year and then you have the rest of they year to plan or recover any benefits you may have lost.

- Contribute to your IRA, 401k, flexible spending account all of these types of contributions are tax exempt. IRA up to a certain amount - about $5500 this year I think.

- Own rental property? Now may be the time to purchase that energy efficient appliance and get the tax credit, plus all the money you put into that rental property is a tax write off which helps to counter balance the income you received throughout the year.

- Donate to a charity! This is the best way to get a tax deduction.. this is like getting the best of both worlds.. save money by giving to others. This is a win win situation and you feel great! Just be careful there is certain criteria that must be met not all donations are tax deductible. You can claim up to $50 each for bags of clothing that you might donate .. for example.

- Speak to your CPA or attorney. Just to be sure, I would consult your CPA or attorney to discuss which advice is best for you as an individual.

Here are some tips for Retirees:

- Do a dry run on your tax return: Retiring can have a major impact on your finances. It is very helpful to start planning now. Do a practice return now using a free online tax software. All the techniques I offered for individuals will benefit you if you are retiring or retired.

- Check and double check your withholding instructions on Social Security, pensions and any early withdrawals. If it is not accurate or enough you may pay heavy penalties and interest. It is really important to check with your estate planner or CPA to be sure.

Here are some money saving tips for small business owners:

- Spend some money - If you make any purchase before the end of the year, you may be able to deduct most of your purchases - for things like computers, furniture, software, vehicles, equipment and more. Even if you don't think you have to, you may want to review. Then check with your CPA to see if Section 179 deduction is still available.

- Hiring a returning or disabled veteran - The returning heroes tax credit provides businesses that hire unemployed veterans a tax credit up to $9,600 per veteran. Read more: Returning Heroes and Wounded Warrior Tax Credits.

- Defer your income - much like for individuals - you may want to review this ahead of time with your CPA or accountant.

- Set up a retirement account or fund one before the end of the year. Check with your plan administrator for limits and deadlines for different types of plans. Contact us if you need a referral.

- Contribute to charity.

- Keep your records straight.

- Speak to your CPA or attorney. Just to be sure, I would consult your CPA or attorney to discuss which advice is best for you as a small business owner.

Sources for information above:

http://www.sba.gov/community/blogs/community-blogs/small-business-cents/7-money-saving-year-end-tax-tips-small-business

http://taxes.about.com/od/taxplanning/qt/year_end_tips.htm

http://www.marketwatch.com/story/year-end-tax-tips-for-retirees-and-pre-retirees-2013-11-21

Friday, November 22, 2013

The Kennedy Assassination, 50th Anniversary Among Other Things

The Tanner Insurance Agency, Inc. does not affiliate with a particular political party however this was such a moment in history. I thought I would blog about it, briefly.

I was too young to remember JFK Jr. but of course I heard a lot about him. Not just through the history books but from my family as well too, as I was growing up.

My grandmother was a huge JFK Jr. fan. She used to collect dollar bills with the letter K on them. Everyone in my family knew this and they would save and give them to her or trade for an none letter K bill. She kept them neatly in an envelope in her top dresser drawer. The envelope was so full it wouldn't close, I can remember.

Now that I think about it she collected lots of things, buttons, bells, and other forms of money. Like the Susan B. Anthony dollar. Coincidentally, she passed away on this day too. The same day as JFK as if she had it planned.

Now that I am in the insurance industry I would have advised her she should check on her homeowner policy to be sure those items are covered. There is usually very limited coverage on a homeowner policy for money and collectibles.

The proper way to insure these types of items is to schedule them on your homeowners or renters policy. Usually only if the items are valued over a specific amount is an appraisal required.

If you have jewelry, guns, furs, antiques, money, coins, or collections (even old buttons), you should check with your insurance carrier or agent to find out what the limitations are on your home or renters policy.

We offer free insurance reviews as well if you need help.

My blog is going to be hosted on our website by Monday - at htttp://www.tiains.com

We will be sure to have the link updated on all the other public sites it is on.

Thanks and Happy Friday!

I was too young to remember JFK Jr. but of course I heard a lot about him. Not just through the history books but from my family as well too, as I was growing up.

My grandmother was a huge JFK Jr. fan. She used to collect dollar bills with the letter K on them. Everyone in my family knew this and they would save and give them to her or trade for an none letter K bill. She kept them neatly in an envelope in her top dresser drawer. The envelope was so full it wouldn't close, I can remember.

(My grandmother is the dark hair lady on the bottom right)

Now that I think about it she collected lots of things, buttons, bells, and other forms of money. Like the Susan B. Anthony dollar. Coincidentally, she passed away on this day too. The same day as JFK as if she had it planned.

Now that I am in the insurance industry I would have advised her she should check on her homeowner policy to be sure those items are covered. There is usually very limited coverage on a homeowner policy for money and collectibles.

The proper way to insure these types of items is to schedule them on your homeowners or renters policy. Usually only if the items are valued over a specific amount is an appraisal required.

If you have jewelry, guns, furs, antiques, money, coins, or collections (even old buttons), you should check with your insurance carrier or agent to find out what the limitations are on your home or renters policy.

We offer free insurance reviews as well if you need help.

My blog is going to be hosted on our website by Monday - at htttp://www.tiains.com

We will be sure to have the link updated on all the other public sites it is on.

Thanks and Happy Friday!

Thursday, November 21, 2013

What to do with all that leftover turkey...

I usually blog about insurance tips and techniques and feel free to go back and check those out. I am a single

parent and work full time. I am always looking for effective short cuts

and quick meals. If you read my blog yesterday, I gave tips and

techniques relating to preparing and cooking your turkey. I also

included how to estimate how much turkey you would need per person. If

you are like me, I love leftover turkey.

It takes hours to prepare the holiday dinner, minutes to eat and then spend several more minutes cleaning up and storing leftovers. I have a small family but always buy a big turkey. You don't need to spend the next week having turkey every night. All the meals I am going to give you are quick and easy and the meat can be frozen and added to a few other key ingredients and you can have a fresh turkey taste.

My favorite is of course the cold turkey sandwich. I usually slice some of the left over breast and keep in the fridge for a couple of turkey sandwiches. I usually have leftover rolls too so I just slice, add a little mayo, salt and pepper and a generous slice of turkey and presto.. turkey sandwich.

I usually leave the other breast whole, wrap in plastic wrap and then in aluminum foil, you can also use freezer bags but just be sure to get all the air out to prevent freezer burn. I will place this into the freezer and save for another meal down the road. The breast will keep for 6 months, but I rarely wait that long to actually eat it.

When I am ready I take out of the freezer, let thaw in the fridge and slice for future cold turkey sandwiches or sometimes make hot turkey sandwiches too! I usually store any leftover gravy in the freezer too. If I don't have leftover gravy, the powdered packet is my favorite above the jar version.

Next after I have removed the breast I usually place the entire turkey, bones and all into a big soup pot add some onions, celery and a little seasoning (garlic,salt, pepper). I have the pot with the strainer built right in. I almost cover about 3/4 with water, bring to a rapid boil, reduce heat to low, cover and let simmer for two hours. Then I remove from heat take the turkey out of the juices and set aside. Now you have instant turkey broth. Once this is cool, I put 1/2 into a container in the freezer and save for future recipes.

Once the turkey is cool I separate all the meat from the bones. Throw out the bones. I use 1/2 of the meat, the entire carrot and celery and dice and put into the 1/2 of the broth that didn't make it into the freezer. Instant turkey soup! I usually just freeze that too, and when I want to serve it I cook up a few egg noodles and throw it it! This is so incredibly quick and easy, I just love it.

The other 1/2 of the meat I use with all the remaining leftovers. I always hope i have leftover stuffing. For some reason when you use a cast iron skillet this comes out best but you can also use a non stick pan for easy clean up! I take the leftover meat that I didn't add to the soup, and place in a pan with any leftover stuffing. My family also uses some other kind of vegetable - besides squash, like green beans (even casserole works), peas, or corn - I usually add that too, and any remaining gravy, heat it all up and plate. It is so yummy!

I hope you enjoy your holiday leftovers as much as you did the first time!

It takes hours to prepare the holiday dinner, minutes to eat and then spend several more minutes cleaning up and storing leftovers. I have a small family but always buy a big turkey. You don't need to spend the next week having turkey every night. All the meals I am going to give you are quick and easy and the meat can be frozen and added to a few other key ingredients and you can have a fresh turkey taste.

My favorite is of course the cold turkey sandwich. I usually slice some of the left over breast and keep in the fridge for a couple of turkey sandwiches. I usually have leftover rolls too so I just slice, add a little mayo, salt and pepper and a generous slice of turkey and presto.. turkey sandwich.

I usually leave the other breast whole, wrap in plastic wrap and then in aluminum foil, you can also use freezer bags but just be sure to get all the air out to prevent freezer burn. I will place this into the freezer and save for another meal down the road. The breast will keep for 6 months, but I rarely wait that long to actually eat it.

When I am ready I take out of the freezer, let thaw in the fridge and slice for future cold turkey sandwiches or sometimes make hot turkey sandwiches too! I usually store any leftover gravy in the freezer too. If I don't have leftover gravy, the powdered packet is my favorite above the jar version.

Next after I have removed the breast I usually place the entire turkey, bones and all into a big soup pot add some onions, celery and a little seasoning (garlic,salt, pepper). I have the pot with the strainer built right in. I almost cover about 3/4 with water, bring to a rapid boil, reduce heat to low, cover and let simmer for two hours. Then I remove from heat take the turkey out of the juices and set aside. Now you have instant turkey broth. Once this is cool, I put 1/2 into a container in the freezer and save for future recipes.

Once the turkey is cool I separate all the meat from the bones. Throw out the bones. I use 1/2 of the meat, the entire carrot and celery and dice and put into the 1/2 of the broth that didn't make it into the freezer. Instant turkey soup! I usually just freeze that too, and when I want to serve it I cook up a few egg noodles and throw it it! This is so incredibly quick and easy, I just love it.

The other 1/2 of the meat I use with all the remaining leftovers. I always hope i have leftover stuffing. For some reason when you use a cast iron skillet this comes out best but you can also use a non stick pan for easy clean up! I take the leftover meat that I didn't add to the soup, and place in a pan with any leftover stuffing. My family also uses some other kind of vegetable - besides squash, like green beans (even casserole works), peas, or corn - I usually add that too, and any remaining gravy, heat it all up and plate. It is so yummy!

I hope you enjoy your holiday leftovers as much as you did the first time!

Wednesday, November 20, 2013

Let's Talk Turkey.....

How to pick the right size turkey: Typically the rule is one pound of turkey for every 1 person, and only use a 1/2 pound per child. You may want to use 1lb for everyone so you have plenty of leftovers.

How to thaw your turkey: If it is a frozen turkey you should take it out of the freezer and leave in the refrigerator for approximately 3-4 days. For larger turkeys it could take up to 6 days.

How to prepare your turkey: Once your turkey is thawed, remove the neck and giblets. I recommend rubbing butter and spices, garlic, salt, pepper on the skin. Some people like to use poultry seasoning as well. You can also rub this between the meat and the skin. I then put that in a dutch oven or deep dish baking pan. I throw the giblets and neck right in the bottom of the pan along with 2-3 cups of water. Cover with a lid or aluminum foil. If you use aluminum foil - stick some tooth picks into the top of the turkey so the foil does not touch the skin.

How long to cook your turkey: Normally the rule is 30 minutes per pound. If it is a twelve pound turkey I cook covered for 5.5 hours, then I uncover, stuff with stuffing, butter the skin again, drain out as much juice as possible and set aside in a separate container or pan, along with the neck and giblets, and place back into the oven uncovered for the half-hour.

While the turkey is back in the oven for the last half hour, I normally make the gravy. I let the pan juices sit for a few minutes, in a clear container is best. The liquid will settle and the fat will sit on top. I take 3-4 tablespoons of that fat and place in a separate pan on high heat on top of the stove, as soon as it starts to boil I turn down the heat to low, add 3 tablespoons of flour, mix thoroughly and then whisk in the remaining pan juices. I also cut up my giblets and throw in at this point.

I hope you have an enjoyable holiday.. enjoy!

Tuesday, November 19, 2013

Why Insurance Agents Worry About Their Clients: Hotel Safety Tips

In my blog yesterday we talked about the holidays fast approaching and the highway travel that would be most likely taking place and some ways to be sure your reach your destination and return home safely. Today lets talk about when you actually arrive. If you are staying in a hotel there are some very important safety precautions you will want to take to be sure you and your family are protected. Even if you think you know the area and you feel 'safe', you can not be too careful. Crime is on the rise.

Before your stay, know your hotel: Don't be afraid to call and ask questions before you make your reservation. Select a hotel that has installed modern electronic guest room locks. Be aware of your hotels surroundings and location. If you are visiting a foreign country, be aware of the security situation there. Call ahead and make sure the front desk is staffed 24 hours a day. Jewelry, luggage and valuables should be photographed before your trip. Be sure your cell phone works even if there is a phone in your room.

Once you arrive, be aware of your surroundings: Immediately familiarize yourself with the fire escape route. Ask the front desk what number should be dialed in case of emergency. Be aware of anyone listening in on your conversation as you check in. Don't let the front desk associate publicize your room number.

During your stay, be on guard: Keep your room key, wallet, flashlight and cell phone on your nightstand. Check the locks on doors and windows as soon as you arrive. At night, use the main entrance. Keep cash, credit cards and checks in separate pockets or areas of your purse. Never open your door to someone unless you are sure of their identity and expecting them.

Below is an infographic offering more safety tips before and during your stay. You should also check with your insurance agent to be sure your belongings will be covered. Some homeowners or renters policies provide coverage anywhere in the world, some in the US only and there is often limitations for jewelry.

If you would like a free review of your insurance policy, please visit us on the web or give us a call at one of our three locations.

Before your stay, know your hotel: Don't be afraid to call and ask questions before you make your reservation. Select a hotel that has installed modern electronic guest room locks. Be aware of your hotels surroundings and location. If you are visiting a foreign country, be aware of the security situation there. Call ahead and make sure the front desk is staffed 24 hours a day. Jewelry, luggage and valuables should be photographed before your trip. Be sure your cell phone works even if there is a phone in your room.

Once you arrive, be aware of your surroundings: Immediately familiarize yourself with the fire escape route. Ask the front desk what number should be dialed in case of emergency. Be aware of anyone listening in on your conversation as you check in. Don't let the front desk associate publicize your room number.

During your stay, be on guard: Keep your room key, wallet, flashlight and cell phone on your nightstand. Check the locks on doors and windows as soon as you arrive. At night, use the main entrance. Keep cash, credit cards and checks in separate pockets or areas of your purse. Never open your door to someone unless you are sure of their identity and expecting them.

Below is an infographic offering more safety tips before and during your stay. You should also check with your insurance agent to be sure your belongings will be covered. Some homeowners or renters policies provide coverage anywhere in the world, some in the US only and there is often limitations for jewelry.

If you would like a free review of your insurance policy, please visit us on the web or give us a call at one of our three locations.

Monday, November 18, 2013

Why Insurance Agents Worry About Their Clients..Road Trips!

As the holiday season approaches more and more individuals and families will be hitting the highway traveling to visit family and friends. We want to make sure you take every precaution to stay safe while traveling near and far.

There is some basic maintenance that should be done to your vehicle to be sure it gets you to and from where you need to be. Like checking your battery, oil, coolant and other fluid levels. Check your tire pressure, air filter, and be sure you have a spare tire. Most importantly, get those repairs done if needed. You may think this is silly but when loading in any potential passengers and all the extra belongings you should also check your vehicles load capacity.There are some things you need to do to be sure you have everything you need. Make sure your latest insurance Identification Card contains accurate information and is located in your glove box with a copy of your registration. We normally give our insurance handy plastic holders to keep these important documents in. It also lists our contact number on the back in case you need to reach us on the road. You should also make a quick call to be sure you know what coverages you have, like towing, rental reimbursement and in some cases trip interruption.

Lastly there should be some things you should have on hand in the event of an emergency. Buy a road atlas or map, GPS or cell phone technology is great when they work. Have a backup plan just in case. Be sure your electronic devices are fully charged, like your GPS or cell phone. A GPS may help so that you are aware of any detours. Buy snacks, bottled water and a first aid kit, including any regular medications. You should also have a blanket during this time of year.

Here is an infographic for easy visual reference about the things I mentioned an a pre-filled list for easy packing! Have a safe trip, a fun holiday and most importantly feel free to contact us with questions.

Friday, November 15, 2013

Why Insurance Agents Worry About Their Clients

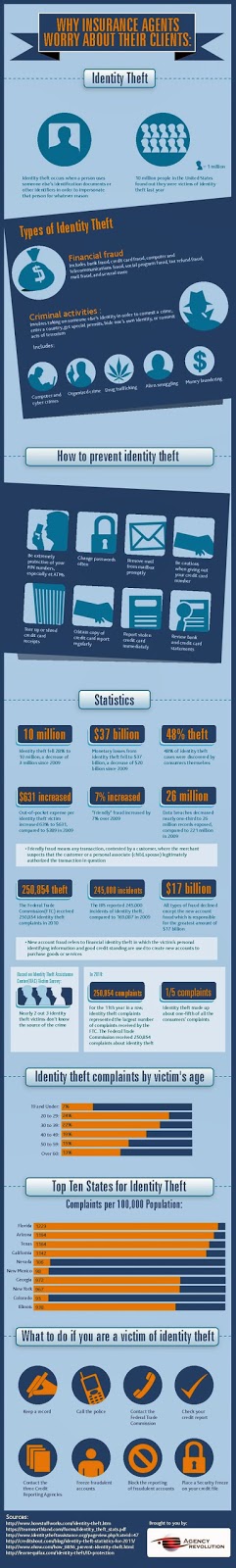

More and more individuals are becoming victims of identity theft. Your

money is insured through the bank or credit card company. If you are a

victim of identity theft and catch it soon enough your bank or credit

card company will cancel the card or account, confirm any recent

transactions and start and investigation process. If you are not aware

of accounts that may have been created in your name or using your

private data it can be very costly and time consuming to recover your

identity.

Recently, many insurance carriers are aware of this problem and automatically include identity theft recovery coverage as part of the coverage provided on your homeowners or renters policy. In some cases this coverage can also be added by endorsement for a small additional charge if not automatically included.

So what exactly is identity theft? Identity theft occurs when a person uses another persons identification documents or other identifiers in order to impersonate that person for what ever reason. Approximately, 10 million individuals in the US were victims of identity theft last year alone. If not caught soon enough, you may need to hire and attorney, lose time from work, pay for duplicate copies of forms, all of which can add up. Most of the policies we offer will pay up to $25,000 to cover these costs.

Please check out the infographic below for more information about identity theft and how to prevent it.

Recently, many insurance carriers are aware of this problem and automatically include identity theft recovery coverage as part of the coverage provided on your homeowners or renters policy. In some cases this coverage can also be added by endorsement for a small additional charge if not automatically included.

So what exactly is identity theft? Identity theft occurs when a person uses another persons identification documents or other identifiers in order to impersonate that person for what ever reason. Approximately, 10 million individuals in the US were victims of identity theft last year alone. If not caught soon enough, you may need to hire and attorney, lose time from work, pay for duplicate copies of forms, all of which can add up. Most of the policies we offer will pay up to $25,000 to cover these costs.

Please check out the infographic below for more information about identity theft and how to prevent it.

To find out if you have identity theft recovery coverage on your policy, even if you are not our current client, contact us at one of our three locations or visit us on the web and get a free insurance review.

Thursday, November 14, 2013

Black Friday vs Cyber Monday

Is anyone else terrified of the Black Friday festivities that are about to commence? I have heard that some people turn selfish and greedy during the shopping process. I decided to attend Black Friday a few years ago because there was a bargain I just HAD TO HAVE. Even though I was well aware that it is known as the busiest shopping day of the year. I was faced with elbow to elbow crowds in every store and mall I dared to venture in. I saw people pushing, shoving, even grabbing... it was horrible.

I promised myself I will never brave Black Friday shopping again. This year the stores will be open for early savings on Thanksgiving as well. I think that is going too far. It is mostly the large chains of retail stores that have decided to open, like Walmart, Target etc. They will reap the rewards by getting some extra revenue they were not able to collect in prior years. The employees will really suffer, instead of enjoying a day off with their families they most likely are being forced to work. Cyber Monday offers a safer, more civil shopping experience that can be enjoyed from home, local coffee shop, or any other place with internet. Today’s infographic offers some interesting stories and information about Cyber Monday and Black Friday. Good luck to all you brave shoppers out there, get those deals and stay strong! [via]

reprinted in parts from dailyinfographic.com

Make sure all your purchases are covered properly, give us a call for a free review of your renters or homeowner policy or for a free quote.

Wednesday, November 13, 2013

Have you ever been victim to a frivolous lawsuit?

Did you know that included in many insurance policies is liability coverage. There are many different types of policies and liability coverage. Your homeowner or renters policy usually provides personal liability. This type of liability is very broad and covers "you" anywhere. Most people think that the liability coverage provided on this type of policy only protects you if someone gets hurt on the property. Actually, it is much broader than that. This is the type of liability coverage I am going to focus on today. Here is some more specific information, in hopefully easy to understand language:

Personal Liability: Found on your homeowners or renters policy. You must read your specific policy language for specifics of what is covered or not covered. Who is covered is also defined in your policy language. However, in most cases "YOU" are a named insured and any resident relatives. Also, in most cases the policy language states that they will pay all sums up to the amount shown on the declaration page which anyone we protect becomes legally obligated to pay as damages because of a personal injury or property damage resulting from an occurrence during the policy period.

A good example is if you are in the supermarket and you accidentally hit someone or perhaps their vehicle with your shopping cart. If you are sued, your insurance company will hire and attorney, investigate, and if necessary go to court and pay any claims up to the limit on your policy.

If your son or daughter, who lives with you, is playing in the yard and accidentally knocks a ball through a window - a neighbors house or car, again you will be protected.

Here is the most important thing I want you to know about this coverage and the least known:

Personal liability coverage is the LEAST expensive coverage on your policy. Often times $100,000 worth of coverage is automatically included in your premium. Did you know that usually for $20-$30 approximately more a year you can make that $1,000,000.

Please contact us if you would like a free review of your current home or renters policy, even if you are with another agent or if you would like to increase your coverage.

You can also contact us on the web and get a free homeowner quote or visit us at one of our three locations.Tuesday, November 12, 2013

The 6 Smartest Things You Can Do Every Night and Morning

Waking up and getting the day started is one of the toughest parts of

the day. Everything you have to do is jumbled and floating around in

your head. You want nothing more than to just stay in bed. But you can’t

because you have a life and people that depend on you. It’s bad enough

that you have responsibilities, but you have to dress nice too? I don’t

know about you all, but picking clothes in the morning is one of the

most frustrating things about starting my day.

We want to do it all. We want to feel energized from our morning exercise. We want to actually get a decent breakfast in. And we want to look good for the day to come. Often striving for these things is what keeps people from being the “morning person” that so many hate at work. Whether we admit it or not we are jealous of the morning people. We envy their positivity and the ease in which they handle the start to their day.

Planning ahead is what is going to get us there. In this infographic, we are shown a few tips and tricks to making the new day a better and easier one. Organizing your thoughts will help you visualize how to efficiently achieve your to-do’s. Doing something that’s going to make you feel good about yourself is a must in the morning. Make yourself a routine to ensure you can be a happier and more successful you. [via]

We want to do it all. We want to feel energized from our morning exercise. We want to actually get a decent breakfast in. And we want to look good for the day to come. Often striving for these things is what keeps people from being the “morning person” that so many hate at work. Whether we admit it or not we are jealous of the morning people. We envy their positivity and the ease in which they handle the start to their day.

Planning ahead is what is going to get us there. In this infographic, we are shown a few tips and tricks to making the new day a better and easier one. Organizing your thoughts will help you visualize how to efficiently achieve your to-do’s. Doing something that’s going to make you feel good about yourself is a must in the morning. Make yourself a routine to ensure you can be a happier and more successful you. [via]

Friday, November 8, 2013

Some of the Most Amazing Houses in the World!

Little boxes on the hillside aren't’ for everyone. While some people might be content with a cookie-cutter home in a bland suburban neighbor hood, others create truly one-of-a-kind homes with incredible imaginative shapes and materials. Here are a few extraordinary examples:

The Upside Down House—Szymbark, Poland

(Images via: Fresh Home)

The Toilet –Shaped House—Suweon, South Korea

The world’s one and only toilet-shaped house was built to mark the launch of the World Toilet Association, a campaign for more sanitary restrooms worldwide. Sim Jae-Duck, nicknamed “Mayor Toilet”, had the 4,508 square foot concrete and glass structure built in his native city of Suweon, South Korea. At the center of the home is a glass-walled “showcase-loo” that produces mist to make users feel more secure. Sim, who was born into a toilet and has made clean restrooms his life work, now lives in the home.

(Image via: Reuters)

The Pod House in New York State

Also known as the Mushroom House, architect James H. Johnson was inspired by the shape of the local wildflower Queen Anne’s Lace, when he designed this unusual home in Powder Mills Park, near Rochester, NY. The home is actually a complex of several pods with connecting walkways. Perched atop thin stems, the pods are amusing yet eerie examples of organic architecture.

(Image via: pointclickhome.com)

For more homes like these check out www.weburbanist.com or architecture.about.com.

Please visit us on the web or contact us at one of our three locations to get a quote or for a FREE insurance review.

Thursday, November 7, 2013

Automobile Insurance—Top five questions

What auto coverage do I need?

New York Law requires all vehicles to carry a minimum amount of liability insurance in the amount of $25,000 for bodily injury to one person, $50,000 for bodily injury to two or more persons (Uninsured motorists protection subject to the same minimums), $10,000 for damage to property of others, and $50,000 for Personal Injury Protection (PIP), also known as No-fault. This minimum coverage are applicable to any one accident. However, depending on your individual situation, it is advisable that you consider increasing the amounts of your liability coverage depending on your needs and the assets you would like to protect.

What optional coverage should I consider purchasing?

You may consider purchasing Comprehensive and Collision coverage to protect against theft or damage to your vehicle. Insurers also offer other valuable coverage to protect you and your family, such as Additional PIP and Supplementary Uninsured/Underinsured Motorists (SUM). It is recommended that you review the Insurance Department’s Consumer Guide to Automobile Insurance, located in the Automobile Insurance Resource Center, for more general information about auto insurance. You may also consult with the producer or insurer to help determine the types of coverage that are ideal for you.

Does my policy protect me for liability against a lawsuit from an injured spouse?

The standard auto policy does not automatically provide coverage for an insured against liability due to death of or injuries to a spouse. However, an insured may purchase Supplemental Spousal Liability, which does provide coverage for an insured against liability due to death of or injuries to a spouse.What effect does my credit history have on my insurance?

Many insurers consider consumer credit information as part of their underwriting process and, for those that do, your credit history may have an affect on the premium charged. However, insurers are prohibited from rejecting an application for insurance solely on the basis of credit information and from using credit in any way to terminate a policy or increase the premium on a renewal policy. Insurers are required to disclose the use of credit information to their policyholders.What discounts are available?

While all insurers are required to offer certain mandatory discounts (such as for vehicles equipped with air bags, anti-lock brakes or daytime running lights, or for taking a DMV approved Accident Prevention Course), many insurers have a wide range of other discounts that may also be applicable to you. Ask the insurer or producer about the discounts offered by the insurer to see if you qualify or could qualify for any of the available discounts.For more visit us on the web or contact us at one of our three locations. You can also visit the insurance department online.

Wednesday, November 6, 2013

Swimming Pool & Spa Safety Tips

Every year the CPSC reports that an estimated 300 children under the age of five drown in swimming pools and spas. And more than 3,000 children in that same age bracket are treated in hospital emergency rooms after sustaining submersion injuries.

Before you prep your swimming pool or spa for summer activities take a moment to read through the following safety tips.

General Pool Safety

- Enclose with a 4 foot fence around all 4 sides. Enclose your pool or spa area on all 4 sides with a fence that is at least 4 feet tall. If your house makes up one side of your fence, install secure locks that are out of reach of children and install alarms. It only takes a moment for a child to wander into danger.

- Remove covers completely. When the time comes to uncover your swimming pool, take the cover completely off. A child can easily become trapped in the portion of the cover that is not removed.

- Install self closing gates. Make sure all gates leading to the pool area are self closing and self latching, with the latches high enough to be out of the reach of children.

- Move tables and chairs. Keep all tables and chairs that are outside the enclosed pool area away from the fence to keep children from climbing into the pool area.

- Have proper rescue equipment. Keep rescue equipment – a shepherd’s hook and life ring – near the pool and in good condition.

- Keep phone close. Keep a phone near the pool whenever it is occupied. You don’t want to leave young swimmers unattended for even a few seconds while you run to answer the phone. It is also crucial to have a phone near the pool in case of emergency.

- Never let children swim unsupervised. Knowing how to swim does NOT mean children are safe in the water. Even children on swim and dive teams have drowned while swimming unsupervised. Never leave children unattended in or near a pool or spa.

- Know CPR. Make certain everyone who is watching over children in the pool knows CPR.

- Educate babysitters. Go over your pool safety rules with all babysitters whether or not the children will be swimming while in their care. Also, insist that your babysitters know CPR.

- Practice “Touch Supervision.” Practice “touch supervision” with children under five years of age. This means children are always within an arm’s reach when in or around the pool.

- Require swimming ability. Never allow children over four years of age in your pool or spa if they don’t know how to swim unless they are accompanied by a parent. Children under four should never be allowed in the pool or spa without a parent.

- Don’t use inflatable swimming aids. Never use inflatable swimming aids – water wings, float tubes, water mattresses, etc. – as a substitute for a certified life vest or floatation device. Be aware that inflatable swimming aids can lead to a false sense of security.

- Remove toys. Remove all toys from the pool or spa after swimming. Children might try to reach for toys in the water and fall in. Putting them in a closed bin or small storage unit will keep them out of sight and reduce the risk of children going into the pool area to get them.

Avoid Drain Entrapment

Drain suction can be powerful enough to trap an adult underwater. Keep children safe by following these drain safety tips.- Keep drains and drain covers in excellent condition. Loose, broken or missing drain covers pose a serious drowning threat.

- Keep children away. Never allow children to go near drains or suction outlets. This is especially dangerous in spas and shallow pools. According to CPSC, “children’s public wading pools, other pools designed specifically for young children, and in-ground spas that have flat drain grates and single main drain systems pose the greatest risk of entrapment.” Anything from hair, to body parts, to jewelry and bathing suits can become caught on a drain cover or entrapped in the drain.

- Have your pool and/or spa inspected. The CPSC recommends that all pool and spa owners contact a licensed professional engineer to regularly inspect drains and covers to make sure they are P&SS Act compliant. They recommend contacting “state or local officials to determine who is qualified in your area.”

Enjoying the water is a wonderful way to escape the heat of summer. Follow these safety tips and have a safe, enjoyable summer.

Visit us on the web or contact us at one of our three locations for a free review of your insurance.

Tuesday, November 5, 2013

SPECIAL REPORT: How to Protect & Improve Your Credit Score

Did you know that having a good credit record could save you $6,000 in interest when buying a $20,000 car over four years? Multiply that by the size of the loan and a longer period and you'll get some idea of the dramatic difference in repayments on a mortgage -- with a poor credit record you could pay as much as $40,000 more on a $300,000, 30-year loan.

Lenders use what's known as a FICO score to decide how much interest you should pay, or if they should even lend to you at all. The higher your score, the lower the likely interest rate. So it obviously makes sense to do all you can to protect and improve that score.

But how do you do that?

Well, your credit rating is under attack on two fronts: First, from the way you run your finances; and second, from crooks who steal credit cards or even assume someone else's identity and run up huge debts.Managing Your FICO Score

Let's talk about your finances first. Your FICO score is calculated by a secret formula by a private company, based on information from the credit reporting agencies. The agencies -- Equifax, Experian, and Transunion -- maintain records of all your credit cards and loan payments, including how much you owe and whether you made your payments in time.You can get a free copy of your credit report from each of the three agencies once a year via the site AnnualCreditReport.com. Avoid other sites offering a free service because this will usually have strings attached. You can't get your FICO score for free though (except as an opening incentive to get you to sign up for a recurring-fee, score-monitoring service), but you can buy it for about 20 bucks from myFICO.com.

A good score is 760 or above and a really bad score is 620 and the difference between the two can account for up to a couple of percentage points in the interest rate you pay. Here are some of the things you can do to keep your score as high as possible.

- First, and most obviously, always make your payments on or before the due date. If this is likely to be a problem, contact the lender to discuss arrangements.

- Try to keep your credit or store card spending at 30% or less of your limit. Note that even if you pay off your card every month, the agencies report on how much you owed before the payment.

- So, bearing the above in mind, spread your payments between several cards to keep that percentage down, and don't ask the card companies to reduce your credit limits!

- For the same reason, consolidating all your debt on to one card may push you over that magical 30% on the chosen card, which could go against your score.

- Hold on to and use your "old" cards -- the ones you've had the longest (and kept in good health) seem to rate highest in calculating your score.

- Monitor you credit reports using the free service mentioned above. Stagger the three reports across the year -- one every four months -- and check for errors in things like credit limits and late payments.

- If you find errors, contact the card company or ledner and ask them to correct them. They may even agree to remove one late payment notice if you've otherwise been a good customer.

- Generally, don't have too many cards, although successfully applying for credit when you've had past financial troubles can sometimes help lift your score.

Protecting Your Credit Record from Crooks

Monitoring those credit agency reports will flag up anything unusual with your cards -- for example, cards or loans taken out in your name that you know nothing about. But you need to be much more vigilant than that because, by the time you identify this kind of activity, your credit record and score may already have been wrecked and it takes an age to set them straight.Instead, you should also monitor all your financial accounts as often as possible to spot discrepancies. If you can access accounts online, you could set up a routine that ensures you check at least one of your accounts every day. If you only get printed statements once a month, check every item carefully.

If you discover any spending that's not yours, notify the card company (there should be a 1-800 number on the back -- keep a separate note of this) or other lender. You should also notify the credit reporting agencies (Equifax 1-800-525-6285; Experian 1-888-397-3742; Transunion 1-800-680-7289) -- and the police, of course.

If either threat to your credit record really worries you, you might consider having your records and accounts professionally monitored. Services usually cost around $15 a month. Search online for "credit record monitoring."

A good credit score will save you money and a good credit record may even be a factor in employment. It pays to look after them.

Please feel free to visit us online or contact us at one of our three locations

.

Monday, November 4, 2013

What May or May Not be Covered on a Standard Homeowner Policy

Did you know that the following may not be covered on a standard homeowner policy?

All insurance policies are limited as to the coverage that they provide, if they did not we would all be paying much higher premiums. Among the things that are not covered, we have identified some coverage options you may want to add to your standard homeowner policy.

- Sump Pump Failure, sewer and drain backup

- Any at home business including daycare

- Any collections, jewelry, guns, furs, silverware, antiques, money, & cold all have very limited coverage

- Earthquake coverage

- Sinkhole collapse

- Watercraft Coverage including their trailers

- Trailers and campers

- Ordinance or law - if at the time of a loss a building code requires you to rebuild to comply with the ordinance - this coverage provides the extra expense to do this.

- Trees, Shrubs, Plants & Lawns

To find out more information or to find out if your policy covers any or all of the above please feel free to visit us on the web or contact us at one of our three locations.

We also offer FREE insurance reviews even if you are not our customer. Contact us and we will go over your current policy and point out any coverage gaps.

Friday, November 1, 2013

Cell Phone Safety - Driving Home the Importance

These days, it’s hard to find someone who does not have a cell phone. Cell phones can be invaluable for those business professionals who spend a lot of time out of the office, or for anyone who wants the added peace of mind knowing they can call for help in an emergency.

Are there laws limiting the use of cell phones while driving?

New York state prohibits the use of cell phones while operating a motor vehicle on a public highway. Violators charged for using a cell phone while operating a motor vehicle can face a fine of up to $100. Hands-free cell phones, however, are permitted.

In 2013, several changes have been made to the law. Now you can face up to 5 driving points. If you are a probationary or junior driver you could be looking at a suspension for 60 days and if it happens a second time revocation. The maximum fines have been increased to $150 for 1st offense,$200 for 2nd offense, and third $400 and lets not forget the surcharge...$93.

Familiarize yourself with your phone

Be sure you review all the literature that comes with your phone. Understand how to use its many features—including speed dial, re-dial and hands-free options.

Many manuals are available for free online.

Be aware of your surroundings and road conditions

If you find yourself in hazardous driving conditions-whether traffic-or weather-related—let your voice mail system pick up the call. A few minutes of paying attention, and pulling over in a safe location, could make a huge difference in your safety and the safety of those around you..

Are there laws limiting the use of portable electronic devices used for text messaging or transmitting electronic data while driving?

Effective Nov. 1, 2009, New York state prohibits the use of electronic devices while operating a motor vehicle on a public highway.

Portable electronic devices include hand-held cell phones, but also include PDAs, laptop computers, pagers, broadband personal communication devices and electronic games. Violators charged for using an electronic device while operating a motor vehicle can face a fine of up to $150.

Stay calm on the phone and on the road

Don’t use driving time to engage in stressful or emotional conversations. They can distract you from driving safely and sensibly, even if you are using a hands-free phone.

Cell phones can be an invaluable business tool or your lifeline in a real emergency. But, remember, when you’re behind the wheel, your most important responsibility is safe driving.

There are new penalties that just went into effect for commercial drivers effective October 28, 2013 - click here for our free report : FREE REPORT FOR MOTOR CARRIERS & COMMERCIAL VEHICLE DRIVERS

For more information visit us on the web at www.tiains.com or contact us at one of our three locations.

Reprinted in parts with permission from PIA Management Services Inc.

Thursday, October 31, 2013

Prevent Water Damage Caused By Winter Ice Dams

What is an Ice Dam?

In the winter a warm attic can melt snow on the roof causing water to run down and re-freeze at the edge of the roof where its colder. If ice builds up it becomes an ‘ice dam’ that blocks water from draining, so the water is forced under the roof covering and into the attic or down inside the walls causing water damage.

How to prevent Ice Dams?

The best way to prevent ice dams is to maintain a cold roof. Use sufficient insulation in the attic to keep the inside warm air from getting into the attic and warming the roof. Also, maintain a cool, well –ventilated attic space that will not allow the roof to warm up.

Is there coverage ?

What to do if you get an ice dam?

First, take immediate steps to prevent further damage and contact our agency. We will verify your coverage and give you instructions for preparing your claim.

Generally, you’ll be asked for repair estimates for structural damage and a list of items that will need repair or replacement. Depending on the amount of damage, an appraiser from your insurance company may need to see the damage. As with any insurance claim, keep all receipts.

Using a long handled snow puller, pull the snow from the roof, back just a few feet from the edge of the eaves before ice has a chance to form. By simply removing the snow along the edge of the roof, you will give melting water a chance to drain from the eaves and prevent the formation of ice dams that may damage your roof.

DO NOT GET ON THE ROOF TO REMOVE SNOW BUILDUP. This is dangerous and you could easily damage the roofing material, resulting in leaks when it rains.

Please contact us, on the web or at one of our three locations, if you would like to know if you have this coverage on your existing homeowner policy - even if you are not a current customer we are happy to provide FREE insurance reviews.

This information is reliable and accurate, but we can not guarantee prevention or that the corrective measures will alleviate damages. Always consult an experienced contractor or other expert to determine the best preventative and corrective action.

Wednesday, October 30, 2013

Teens Behind The Wheel

The Statistics:

Five Principal Reasons Contributing to Teen Driving Problems:

- Distraction

- Speeding

- Drinking

- Seat Belts

- Weather

What’s A Parent To Do?

- Choose vehicles for safety, not image. Ensure the car has airbags and anti-lock brakes

- Provide new drivers with plenty of supervised driving practice, even after they have their license. Including night driving and hazardous road conditions

- Mandate safety belt usage

- Restrict number of passengers. Crash rates increase sharply when a teen has passengers especially other teens.

- Emphasize that safe driving requires your teen’s full attention. Distractions like text messaging will greatly increase their risk of motor vehicle related injury

- Discuss and reinforce responsible driving behavior with teenagers.

Download our FREE Parent - Teen Driving Contract - Click Here

Visit us at www.tiains.com or contact us at one of our three locations.

Tuesday, October 29, 2013

Want to Save Money on Gas?

Gas is expected to reach $5 per gallon by next summer. Wow!!! Here are some tips that might come in handy.

4 Tips on Pumping Gas

Our source for this article is an individual with about 31 years experience in the petroleum industry. He was kind enough to share some actions to take that will help you get more out of your money.

- It is wise to buy gas or fill up your vehicle as early in the morning as possible, or when ground temperatures are still cool. Be advised that all service stations have their storage tanks buried below the surface. The cooler the ground the more dense the gasoline. When it gets warmer liquid expands. As a result, buying in the afternoon or in the evening is not recommended. A gallon might not actually be a gallon.

- When you're filling up your car, you should not squeezed the trigger of the pump to a fast mode. Triggers have 3 speeds (low, medium, and high). He advised that one should be pumping on the low mode, thereby minimizing the vapors that are created while pumping gas. All hoses at the pump have a vapor return. If you are pumping on the fast rate, some of the liquid that goes back to your tank can become steam. Those vapors are being sucked up and back into storage tanks, so in retrospect., you are getting "bang for your buck".

- One of the most important tips is to fill up when your gas tank in HALF FULL. The reason for this is the more gas you have in your tank the less air occupying its empty space. Gasoline evaporates faster than you can imagine. Gasoline storage tanks have an internal floating roof. This roof serves as zero clearance between the gas and the atmosphere, so it minimizes the evaporation. Unlike service stations, petroleum stations make sure that every truck that is loaded is temperature compensated so that every gallon is actually the exact amount.

- Finally, never fill up your vehicle when there is a gasoline truck filling up the storage tanks. When the tanks are filled up, the bottom is being stirred up. You will pick up some of the gunk that was lying quietly at the bottom.

Visit us on the web or contact us at one of our three locations maybe we can save you some money on your auto insurance too!

Subscribe to:

Posts (Atom)